Buy More of a Folio

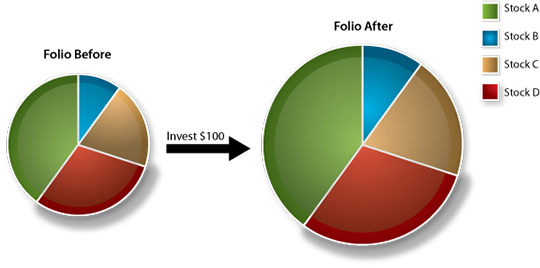

Buy Express

Enter the amount you would like to invest and we’ll buy more of each of your folio’s securities in proportion to their current weights.

Why Do This?

Use “Buy Express” when you like your folio just as it is, and you want to invest more money in it to increase the overall value.

Example: A Folio with Four Securities

Results

- More shares of all securities.

- Current weights remain the same.

- All the securities are the same percentage of your folio’s value. Only the total folio value has changed.

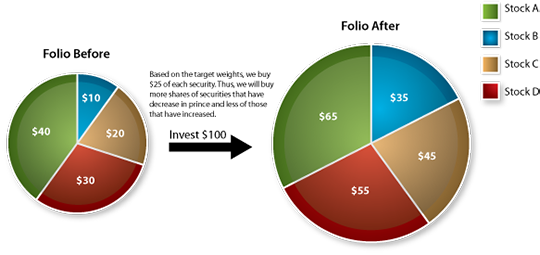

Buy Dollar-Cost Average

Enter the amount you would like to invest and we’ll buy more of each of your folio’s securities in proportion to their target weights.

Why Do This?

Use “Buy Dollar-Cost Averaging” when you want to invest about the same dollar amount at periodic intervals. You want to invest at your target weights, because the current weights fluctuate with the market. When you invest a fixed amount at set intervals according to target weights, you buy more shares of a security when the price is low and fewer shares when the price is high. Therefore, theoretically you have reduced the overall cost of your investment.

Example: A Folio with Four Securities

Each security used to be 25% of your folio’s total value—so each security had a target weight of 25%. Over time, the proportion of each security’s value in your folio has changed so that your current weights have shifted. Based on the target weights, we buy $25 of each security. **Thus, we will buy more shares of securities that have decreased in price and less of those that have increased.

Results

- More shares of all securities.

- The current and target weights will still be different, but the current weights are now closer to the target weights.

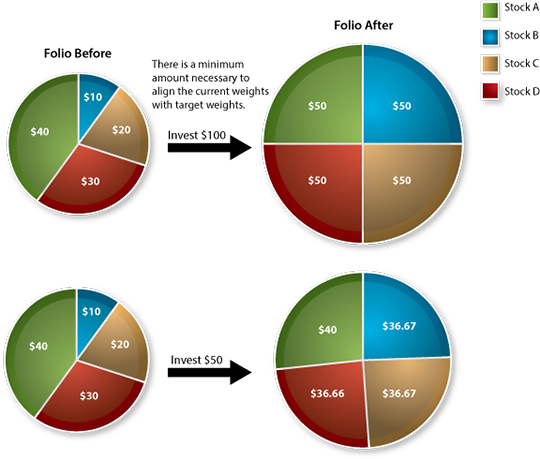

Buy-Only Rebalance

Enter the amount you would like to invest. If you invest less than the calculated minimum, we will balance your folio as closely as possible without selling any shares. If you invest more than the calculated minimum, we will first buy securities to align your current weights with your target weights, then we will buy more of all securities in proportion to their target weights.

Why Do This?

Use “Buy-Only Rebalance ”when you wish to add to your folio’s value and you want your current weights to try to align with your target weights—without selling any shares.

Example: A Folio with Four Securities

Each security used to be 25% of your folio’s total value—so each security had a target weight of 25%. Over time, the proportion of each security’s value in your folio has changed so that your current weights have shifted. We calculate what the minimum amount necessary is to align current weights with target weights.

Results

- Current weights now equal target weights.

- More shares of each security because of your added investment.

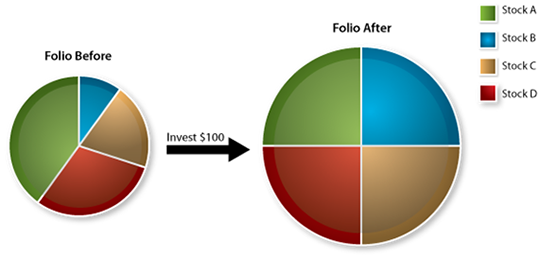

Buy and Rebalance

Use “Buy and Rebalance” when you wish to add to your folio’s value and rebalance the underlying holdings to saved target weights. We will buy and sell securities in the folio to make sure that the resulting positions are aligned with your target weights.

Example: A Folio with Four Securities

Each security used to be 25% of your folio’s total value—so each security had a target percentage of 25%. Over time, the proportion of each security’s value in your folio has changed so that your current weights have shifted.

Results

- Current weights now equal target weights.

- Folio value increased by investment amount.

Sell Some or All of a Folio

Sell Express

Enter the amount you would like to sell and we’ll sell some of each of your folio’s securities in proportion to their current weights.

Why Do This?

You should use “Sell Express” when you like your folio as it is, but you want to subtract shares from all holdings.

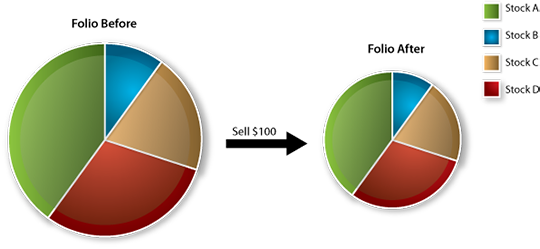

Example: A Folio with Four Securities

Each security used to be 25% of your folio’s total value—so each security had a target weight of 25%. Over time, the proportion of each security’s value in your folio has changed so that your current weights have shifted.

Results

- Less of all securities.

- Current weights remain the same.

- All the securities are the same percentage of your folio’s value. Only the total folio value has changed.

Sell-Only Rebalance

Enter the amount you would like to sell. If you sell less than the calculated minimum, we will sell securities to align your current weights as closely as possible with your target weights without buying any shares. If you sell more than the calculated minimum, we will align your current weights with your target weights, then sell more of all securities in proportion to their target weights.

Why Do This?

Use “Sell-Only Rebalance” when you wish to reduce your folio’s value and want your current weights to try to align with your target weights—without buying any shares.

Example: A Folio with Four Securities

Each security used to be 25% of your folio’s total value—so each security had a target weight of 25%. Over time, the proportion of each security’s value in your folio has changed so that your current weights have shifted. We calculate what the minimum amount necessary is to align current weights with target weights.

Results

- Current weights now equal target weights.

- Less of all securities and less value in total folio.

Sell and Rebalance

Use “Sell and Rebalance” when you wish to reduce your folio’s value and rebalance the underlying holdings to saved target weights. We will buy and sell securities in the folio to make sure that the resulting positions are aligned with your target weights.

Example: A Folio with Four Securities

Each security used to be 25% of your folio’s total value—so each security had a target percentage of 25%. Over time, the proportion of each security’s value in your folio has changed so that your current weights have shifted. We calculate what the minimum amount necessary is to align current weights with target weights.

Results

- Current weights now equal target weights.

- Requested amount delivered to account as cash.

Sell Entire Folio

When you wish to empty your folio, use “Sell Entire Folio.” If you wish to swap your folio for a Ready-to-Go folio or one of your watch folios, go to the Update or Exchange tab.

Why Do This?

Use “Sell Entire Folio” when you wish to liquidate all of your holdings and receive the proceeds. We automatically place your proceeds into your Cash & Money Funds.

Example: A Folio with Four Securities

Results

- An empty folio.

- Proceeds in your Cash & Money Funds, accessible from the Accounts page.

- To close your empty folio, look under “Folio Details” on the Manage Holdings page.

Update & Exchange

Rebalance

You choose to rebalance. We calculate what to buy and sell in order to align your current weights with your target weights—while keeping your folio’s value the same.

Why Do This?

You should use “Rebalance” when you want to re-align your target weights with your current weights—without changing your folio’s value.

Example: A Folio with Four Securities

Each security used to be 25% of your folio’s total value—so each security had a target weight of 25%. Over time, the proportion of each security’s value in your folio has changed so that your current weights have shifted.

Results

- Current weights now equal target weights.

- The value of your folio remains unchanged.

Update

Our system assesses which securities you already have and we’ll buy and sell only what is needed to ensure your folio matches the current version of this Ready-to-Go folio.

Why Do This?

You should use “Update” when you want your folio to reflect the current version of the Ready-to-Go folio without changing your folio’s value.

Example: A Folio with Four Securities

Each security used to be 25% of your folio’s total value—so each security had a target weight of 25%. Over time, the proportion of each security’s value in your folio has changed so that your current weights have shifted.The Ready-to-Go folio you want has been updated over time and now contains 4 securities, A, C, D and T, 25% each.

Results

- You keep A, C, and D but now you have the same proportions as the current version of this Ready-to-Go folio.

- We buy T and sell B to match the current version of this Ready-to-Go folio.

- Our system retains the appropriate amount of each security and buys and sells only the shares of each security needed to complete the update.

Exchange for a Ready-to-Go Folio

Our system assesses which securities you already have and we’ll buy and sell only what is needed. If the new folio you select contains a security present in your old folio, you’ll continue to own the appropriate proportion of that security rather than having to sell and re-buy it.

Why Do This?

You would choose to exchange when you wish to swap your folio with a Ready-to-Go folio.

Example: A Folio with Four Securities

You select to exchange your current folio for a different Ready-to-Go folio and choose to:

Results

- Your old folio and your new folio have the same value.

- You have exchanged your existing folio for a new Ready-to-Go folio.

- Security D remains because it is a holding of the old folio and the new folio—but some of it may be bought or sold to reflect the appropriate percentage in the new folio.

Exchange for a Watch Folio

Our system assesses which securities you already have and we’ll buy and sell only what is needed. If your current folio contains a security present in your watch folio, you’ll continue to own that security (although some of it may be bough or sold) to reflect the appropriate proportion of that security from your watch folio.

Why Do This?

You should choose to exchange when you wish to swap your folio and buy securities listed in your watch folio.

Example: A Folio with Four Securities

You select your watch folio and choose to:

Results

- Your old folio and your new folio have the same market value.

- You still have your watch folio.

- You have bought the securities listed in your watch wolio and sold the securities in your old folio as needed to reflect the watch folio.

- Security D remains because it is a holding of the old folio and the new folio—but some of it may be bought or sold to reflect the appropriate percentage in the new folio.